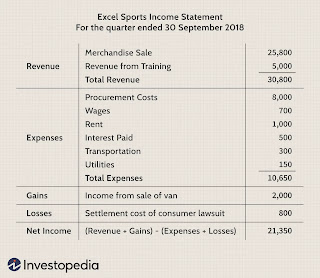

Income statement

- Primarily focuses on the company’s revenues and expenses during a particular period

- Also known as the profit and loss statement or the statement of revenue and expense

- Structure: Focuses on four key items—revenue, expenses, gains, and losses

- Net Income = (Total Revenue + Gains) – (Total Expenses + Losses)

- Revenues and Gains

- Operating revenues

- i.e., revenue achieved from the sale of the product

- Non-operating revenues

- e.g., revenue from interest, rental income from business property, income from strategic partnerships like royalty payment receipts, etc

- Gains

- e.g., the net income realized from one-time non-business activities, like a company selling its old transportation van, unused land, or a subsidiary company

- Expenses and Losses

- Primary activity expenses

- e.g., the cost of goods sold (COGS), selling, general and administrative expenses (SG&A), depreciation or amortization, and research and development (R&D) expenses

- Secondary activity expenses

- e.g., interest paid on loan money

- Losses as expenses

- e.g., one-time or any other unusual costs, or expenses towards lawsuits

No comments:

Post a Comment