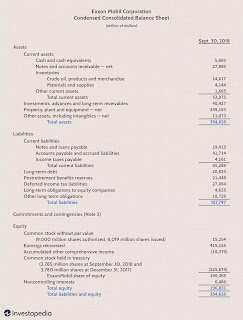

Balance sheet

- reports a company's assets, liabilities and shareholders' equity at a specific point in time

- i.e., a snapshot of what a company owns and owes, as well as the amount invested by shareholders

- Formula

- Assets=Liabilities+Shareholders’ Equity

- a company has to pay for all the things it owns (assets) by either borrowing money (taking on liabilities) or taking it from investors (issuing shareholders' equity)

- Assets

- listed from top to bottom in order of their liquidity

- i.e., the ease with which they can be converted into cash

- Current assets

- Case and case equivalents

- e.g., hard currency (e.g., $), treasury bills, short-term certificates of deposit (i.e., CD)

- Marketable securities

- e.g., common stocks, treasury bills, etc.

- Accounts receivables

- Inventory

- Prepaid expenses

- e.g., insurance, advertising contracts or rent

- Non-current or long-term assets

- i.e., will not or cannot be liquidated in the next year

- Fixed assets

- e.g., land, machinery, equipment, buildings

- Intangible assets

- e.g., intellectual property and goodwill

- Liabilities

- Current liabilities

- due within one year

- e.g., bank indebtedness, interest payable, wages payable, customer prepayments, dividends payable, accounts payable, current portion of long-term debt

- Long-term liabilities

- due at any point after one year

- e.g., interest and principal on bonds issued, pension fund liability (i.e., pay into employees' retirement accounts), deferred tax liability

- Shareholders' equity

- i.e., the money attributable to a business' owners (i.e., net assets)

- Retained earnings

- i.e., the amount of net income left over for the business after it has paid out dividends to its shareholders

- Treasury stocks, etc.

No comments:

Post a Comment