Interest rates

- Central banks often change their target interest rates in response to economic activity

- Raising rates

- when the economy is overly strong

- Lowering rates

- when the economy is sluggish

- Lowering rates

- Makes borrowing money cheaper.

- This encourages consumer and business spending and investment and can boost asset prices

- Lowering rates, however, can also lead to problems such as inflation and liquidity traps

- c.f. Liquidity traps

- A contradictory economic situation in which interest rates are very low and savings rates are high, rendering monetary policy ineffective

- During a liquidity trap, consumers choose to avoid bonds and keep their funds in cash savings because of the prevailing belief that interest rates could soon rise

- The lower the interest rate, the more willing people are to borrow money to make big purchases, such as houses or cars.

- When consumers pay less in interest, this gives them more money to spend, which can create a ripple effect of increased spending throughout the economy.

- Businesses and farmers also benefit from lower interest rates, as it encourages them to make large equipment purchases due to the low cost of borrowing.

- This creates a situation where output and productivity increase.

- Raising rates

- Higher interest rates mean that consumers don't have as much disposable income and must cut back on spending.

- When higher interest rates are coupled with increased lending standards, banks make fewer loans.

- This affects not only consumers but also businesses and farmers, who cut back on spending for new equipment, thus slowing productivity or reducing the number of employees.

- The tighter lending standards also mean that consumers will cut back on spending, and this will affect many businesses' bottom lines.

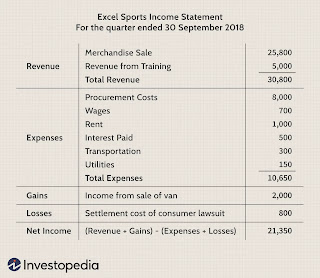

- c.f., bottom line

- A company's earnings, profit, net income, or earnings per share (EPS).

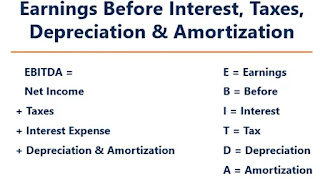

- When inflation

- Inflation

- Refers to the rise in the price of goods and services over time.

- It is the result of a strong and healthy economy.

- To help keep inflation manageable, the Fed watches inflation indicators such as the Consumer Price Index (CPI) and the Producer Price Index (PPI).

- c.f., CPI

- A measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care.

- It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them.

- Changes in the CPI are used to assess price changes associated with the cost of living.

- The CPI is one of the most frequently used statistics for identifying periods of inflation or deflation.

- c.f., PPI

- A group of indices that calculates and represents the average movement in selling prices from domestic production over time.

- The PPI measures price movements from the seller's point of view. Conversely, the consumer price index (CPI) measures cost changes from the viewpoint of the consumer.

- When these indicators start to rise more than 2–3% a year, the Fed will raise the federal funds rate to keep the rising prices under control.

- Because higher interest rates mean higher borrowing costs, people will eventually start spending less.

- The demand for goods and services will then drop, which will cause inflation to fall.

- How affecting stock and bond market